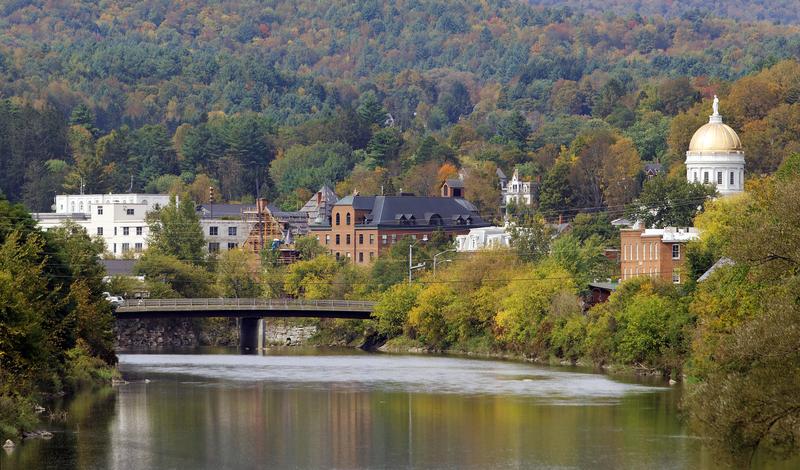

New England, a region known for its significant historical sites, vibrant cultural life, and breathtaking landscapes, offers a diverse array of living experiences. From the bustling cities of Boston and Providence to the serene beauty of the Maine coast and the Green Mountains of Vermont, New England provides a unique blend of urban sophistication and rural tranquility. Whether you’re drawn to the academic and technological hubs of Massachusetts, the maritime heritage of Connecticut and Rhode Island, or the outdoor adventures in New Hampshire and Vermont, Local Jumbo is here to guide you through the real estate market with mortgage solutions tailored to the New England lifestyle.

Ready to explore homeownership in New England? From historic homes in colonial towns to modern apartments in thriving cities and peaceful retreats in the countryside, our network of Jumbo Verified™ lenders offers competitive rates and personalized mortgage plans. Discover your home financing options in New England today.

Tailored Mortgage Solutions for New England’s Diverse Real Estate

Reflecting the region’s broad appeal, New England’s housing market offers a wide range of properties. Our lenders specialize in mortgage strategies that accommodate the variety of homes found across the six states, helping you find the ideal home to suit your preferences and lifestyle.

- A comprehensive array of mortgage types for New England properties: ARMs, FHA, VA, Interest-Only, Jumbo, and conforming loans.

- Financing solutions designed for all types of properties, from urban dwellings in bustling cities to rustic homes in quaint villages and scenic rural areas.

- Personalized mortgage plans that reflect the unique character of New England, supporting both the region’s historical heritage and its contemporary living spaces.

- Expertise in New England’s housing market, with specialized financing options like Land, Construction, and Bridge loans.

- Competitive rates to support your home purchase or refinancing in New England, making homeownership accessible and fulfilling.

2024 MASSACHUSETTS LOAN LIMITS BY COUNTY

| County | One-Unit Limit | Two-Unit Limit | Three-Unit Limit | Four-Unit Limit |

| ARNSTABLE COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| ERKSHIRE COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| RISTOL COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| DUKES COUNTY | $1,149,825 | $1,472,250 | $1,779,525 | $2,211,600 |

| ESSEX COUNTY | $862,500 | $1,104,150 | $1,334,700 | $1,658,700 |

| FRANKLIN COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| HAMPDEN COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| HAMPSHIRE COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| MIDDLESEX COUNTY | $862,500 | $1,104,150 | $1,334,700 | $1,658,700 |

| NANTUCKET COUNTY | $1,149,825 | $1,472,250 | $1,779,525 | $2,211,600 |

| NORFOLK COUNTY | $862,500 | $1,104,150 | $1,334,700 | $1,658,700 |

| PLYMOUTH COUNTY | $862,500 | $1,104,150 | $1,334,700 | $1,658,700 |

| SUFFOLK COUNTY | $862,500 | $1,104,150 | $1,334,700 | $1,658,700 |

| WORCESTER COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

2024 RHODE ISLAND LOAN LIMITS BY COUNTY

| County | One-Unit Limit | Two-Unit Limit | Three-Unit Limit | Four-Unit Limit |

| BRISTOL COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| KENT COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| NEWPORT COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| PROVIDENCE COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| WASHINGTON COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

2024 CONNECTICUT LOAN LIMITS BY COUNTY

| County | One-Unit Limit | Two-Unit Limit | Three-Unit Limit | Four-Unit Limit |

| FAIRFIELD COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| HARTFORD COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| LITCHFIELD COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| MIDDLESEX COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| NEW HAVEN COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| NEW LONDON COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| TOLLAND COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| WINDHAM COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

2024 VERMONT LOAN LIMITS BY COUNTY

| County | One-Unit Limit | Two-Unit Limit | Three-Unit Limit | Four-Unit Limit |

| ADDISON COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| BENNINGTON COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| CALEDONIA COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| CHITTENDEN COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| ESSEX COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| FRANKLIN COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| GRAND ISLE COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| LAMOILLE COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| ORANGE COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| ORLEANS COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| RUTLAND COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| WASHINGTON COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| WINDHAM COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| WINDSOR COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

2024 MAINE LOAN LIMITS BY COUNTY

| County | One-Unit Limit | Two-Unit Limit | Three-Unit Limit | Four-Unit Limit |

| ANDROSCOGGIN COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| AROOSTOOK COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| CUMBERLAND COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| FRANKLIN COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| HANCOCK COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| KENNEBEC COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| KNOX COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| LINCOLN COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| OXFORD COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| PENOBSCOT COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| PISCATAQUIS COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| SAGADAHOC COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| SOMERSET COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| WALDO COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| WASHINGTON COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| YORK COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

2024 NEW HAMPSHIRE LOAN LIMITS BY COUNTY

| County | One-Unit Limit | Two-Unit Limit | Three-Unit Limit | Four-Unit Limit |

| BELKNAP COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| CARROLL COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| CHESHIRE COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| COOS COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| GRAFTON COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| HILLSBOROUGH COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| MERRIMACK COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| ROCKINGHAM COUNTY | $862,500 | $1,104,150 | $1,334,700 | $1,658,700 |

| STRAFFORD COUNTY | $862,500 | $1,104,150 | $1,334,700 | $1,658,700 |

| SULLIVAN COUNTY | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

GET YOUR QUOTE TODAY!

SERVING BUT NOT LIMITED TO THE FOLLOWING COMMUNITIES IN AND AROUND NEW ENGLAND

Neighborhoods

Greenwich (CT), Newtown (CT), Weston (CT), Fenwick (CT), New Canaan (CT), Newton (MA), Weston (MA), Dover (MA), North End (MA), Back Bay (MA), Beacon Hill (MA), Waterfront (MA), Perkins Cove (ME), Bedford (NH) & New Castle (NH).

Zip Codes

02115, 02116, 02118, 02124, 02128, 02130, 02131, 02135, 06807, 06830, 06831, 06836, 06870, 06878, 03801 & 03854

Counties

Suffolk County, Nantucket County, Dukes County, Bristol County, Fairfield County, Litchfield County, Tolland County, Middlesex County, Hartford County, New London County, New Haven County & Windham County.